CBDT Probes Tax Evasion Through Cryptocurrency

High-Risk Individuals Under Investigation for Tax Non-Compliance

The Central Board of Direct Taxes (CBDT) is looking into several high-risk individuals. These people are suspected of avoiding taxes. They are also accused of laundering money through cryptocurrency investments.

Identifying Non-Compliant Entities

The CBDT has identified certain entities and individuals for verification. These entities were involved in Virtual Digital Asset (VDA) transactions. However, they did not follow the Income Tax Act provisions.

Taxation Laws on Virtual Digital Assets

Three years ago, Finance Minister Nirmala Sitharaman changed the law. This change requires a flat 30% tax on income from VDA transfers. This tax includes applicable surcharges and cess.

- You cannot deduct expenses, except for the cost of acquisition.

- You cannot offset or carry forward losses on these investments.

The review of VDA returns is for the financial years 2022-23 and 2023-24.

Income Tax Department’s Data Analysis

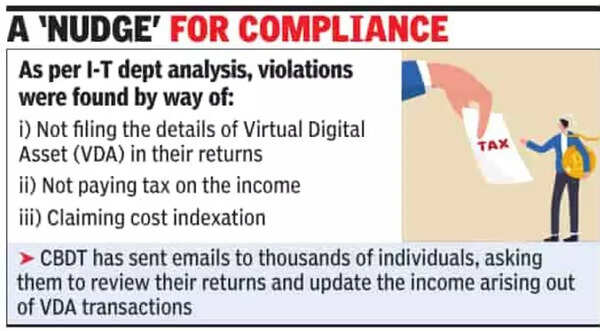

The income tax department’s data analysis found several violations. Many individuals did not file details of VDA in their returns. Some did not pay tax on the income. Others claimed cost indexation.

The CBDT has sent emails to thousands of individuals. These emails ask them to review and update their returns. They need to include income from VDA transactions.

Government’s Nudge Philosophy

This action is part of the department’s recent “nudge” philosophy. The hope is that these emails will prompt action. Only those who do not respond or correct their returns will face further action.

The government has not yet recognized cryptocurrency as an asset class. However, it decided to impose a flat 30% tax on VDAs. Additionally, a 1% tax is deducted at source (TDS) on the sale consideration.

Cryptocurrency Lobby and Government’s Stance

This decision received negative comments from the crypto lobby. They stated that exchanges would shut down. Trading would move out of the country and operate through illegal means.

There has been lobbying for recognizing crypto as an asset. The government believes there needs to be a global push for cross-border regulation. The long-awaited consultation paper is expected soon.