How the Iran-Israel Conflict Affects Global Stock Markets

Understanding the Impact of Geopolitical Tensions

Representative image (Photo: AP)

The ongoing conflict between Iran and Israel is making waves in global markets. It’s also affecting crude oil prices. Investors everywhere, including those on Dalal Street, are feeling the effects. Israel’s main index, TA35, showed strong resistance during mid-session on Sunday. This could help prevent a selling frenzy when markets open on Monday, say experts.

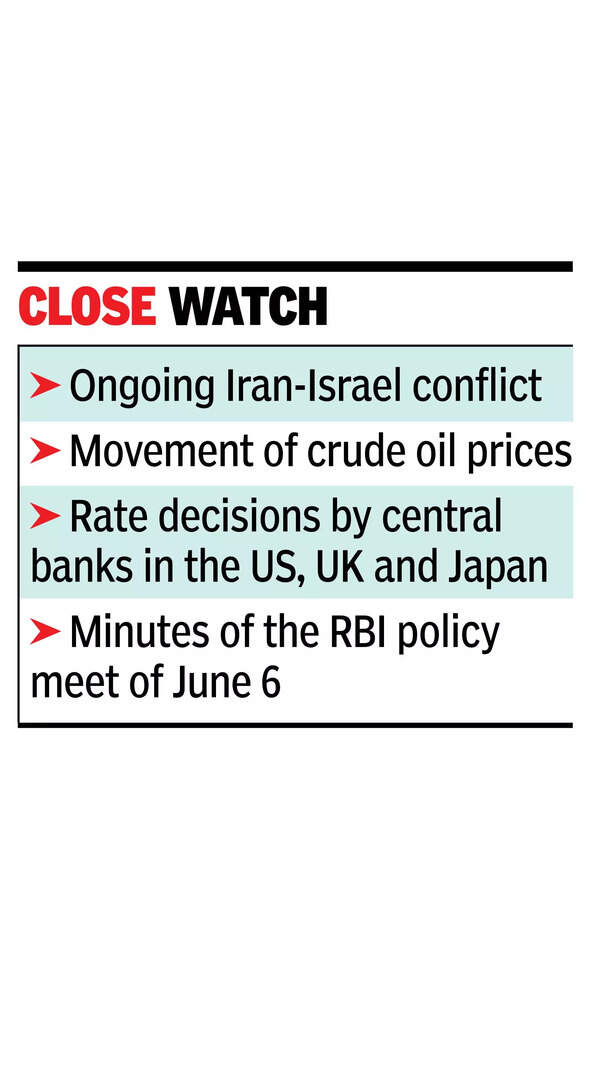

What to Keep an Eye On

- Interest rate decisions by major central banks

- Minutes from the RBI’s policy meeting

- Monsoon progress updates

- Foreign Institutional Investor (FII) trading trends

Last Friday, news broke about Israel attacking Iran and Iran’s retaliation. This caused the Sensex and Nifty to drop sharply. However, they recovered later in the session. The Sensex closed at 81,119 points, and the Nifty ended at 24,719 points. Both were down by about 0.7%.

Market Swings and Central Bank Meetings

Ajit Mishra of Religare Broking believes markets will stay volatile. This is due to the ongoing uncertainty in West Asia and key central bank meetings. Everyone is watching the US Federal Reserve’s upcoming policy decision. Global market participants want clarity on the timing and size of potential rate cuts. This is especially true with mixed economic signals.

More Factors to Consider

Investors should also look at other factors. These include the minutes from the RBI’s policy meeting on June 6, which come out this week. The progress of the monsoon and the FII trading trend are also important.