Updated Bank Locker Agreement: Key Details

The revised locker agreement now lets customers seek legal help if banks don’t protect their locker contents. (AI image)

Have You Signed the New Locker Agreement?

If not, you might lose access to your bank locker. Many customers could face this issue if they don’t sign the new rental agreement.

Important Points to Note

- About 20% of locker users may lose access for not meeting the new rules on time.

- The new agreement allows customers to take legal action if banks don’t protect their locker contents.

- Banks are acting against non-compliant customers as the Reserve Bank of India (RBI) checks compliance levels.

Actions Taken by Banks

Banks are sending reminder notices to customers about agreement renewals. A government official confirmed they are reviewing appeals from public sector banks.

Bank Locker Agreement

RBI Guidelines and Deadlines

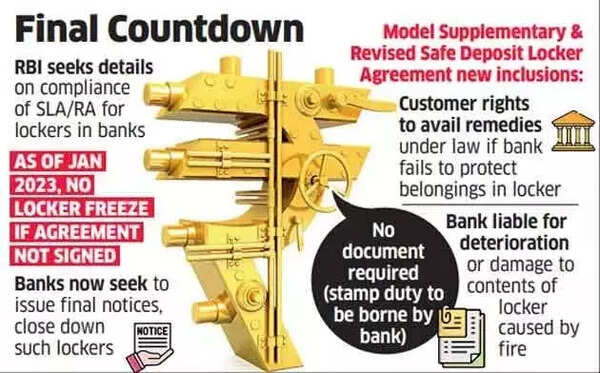

The RBI updated its guidelines for locker agreements. Banks had to fully implement these by March 2024. In August 2021, the RBI told banks to implement revised agreements with existing locker holders by January 1, 2023. This was due to tech advancements, customer complaints, and feedback.

The RBI extended the implementation deadline to December 2023, and then to March 2024.

Customer Responses and Bank Requests

Some customers haven’t responded despite reminders. There are also genuine cases due to legal issues between parties involved.

During talks with the RBI, banks have asked for permission to suspend locker operations. They also want to issue notices when customers fail to comply.

Banks have requested to extend the compliance date of March 2024. They suggest December 2025 as the new deadline for full compliance with RBI regulations.

More Resources