How the Israel-Iran Conflict Affects the Market

Dalal Street Reacts to Global Tensions

Mumbai’s Dalal Street had a rough day. The market felt the impact of the US involvement in the Israel-Iran conflict. Early Sunday, the US bombed Iran’s nuclear sites. This caused a shaky start for the Sensex.

Market Starts in the Red

The Sensex opened low. It stabilized as it became clear that Iran’s response would not be immediate. In early trades, the Sensex dropped over 800 points. It recovered to close 511 points lower at 81,897 points.

Nifty Follows Similar Trend

On the NSE, Nifty followed a similar trend. It closed 141 points lower, below the 25,000 mark. Several factors contributed to this decline:

- Increased tension in West Asia

- Rise in crude oil prices

- Pressure on the rupee

- Selling by foreign funds

Expert Insights

Vinod Nair of Geojit Investments noted that market players bought stocks last week. They expected tensions in West Asia to ease. The US had announced a two-week window to consider its involvement in the conflict.

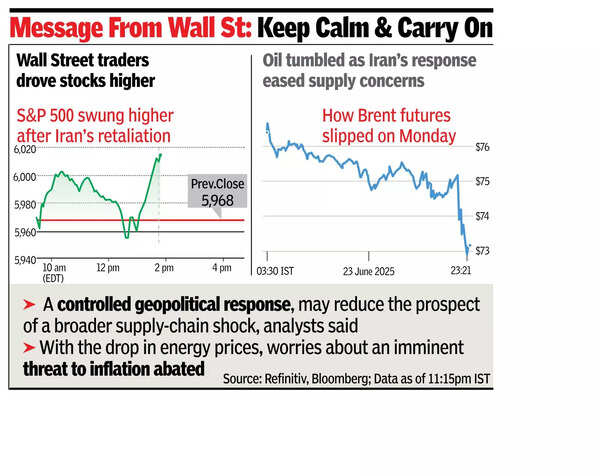

“However, the unexpected US airstrike on Iran’s nuclear facilities over the weekend changed expectations. This caused a sharp rise in crude oil prices. It led to consolidation in the domestic equity market,” said Nair.

Despite the initial setback, the market recovered most of its losses. Capital goods and metal stocks showed gains. Fears of an immediate oil supply disruption remained low.

Foreign Funds Lead the Day’s Session

Foreign funds saw a net outflow of Rs 1,875 crore. BSE data showed this trend. Meanwhile, domestic funds were net buyers at Rs 5,592 crore.

Selling focused on large-cap stocks. Midcap and smallcap stocks mostly closed with gains. BSE’s midcap index closed 0.2% higher. The smallcap index was up 0.6%. This compared to the Sensex’s 0.6% loss.

As a result, the combined wealth of investors increased. It rose by about Rs 10,000 crore to Rs 447.8 lakh crore. Official data showed this rise.

Market Players Expect Continued Volatility

For Tuesday, market players expect volatility to continue. They are waiting for clarity on the tension in West Asia. Until then, the market is likely to remain unstable.