BPM Sector: Adapting to Slowdown and Embracing Automation

Major Changes in the BPM Industry

The Business Process Management (BPM) sector is evolving quickly. It began as a method to reduce costs in “non-core” and “back-office” tasks. Today, it spans the entire business process value chain. Companies are increasingly using AI to improve efficiency.

Growth Rates and Influential Factors

The leading 50 BPM providers experienced a growth slowdown to 4.5%-5.5% in 2023. This is a decrease from 7.5%-8.5% in 2022. Everest Group’s report outlines three primary reasons for this shift:

- A challenging macroeconomic climate impacting global business in hi-tech, mortgage, and telecom sectors.

- An increase in onshore work moving offshore.

- A significant rise in demand for process automation.

A decade ago, BPM firms grew by 3.5%.

Future Growth and Industry Perspectives

Rajesh Ranjan, Managing Partner at Everest Group, offers his insights: “The BPM sector is outpacing IT services in growth. By 2025, we anticipate global BPM growth of about 4.5%-5%. IT services are expected to grow around 1.5%-2%. In a cost-sensitive world, BPM is swiftly adopting next-gen automation (including AI), skilled labor, and deep expertise to deliver value faster.”

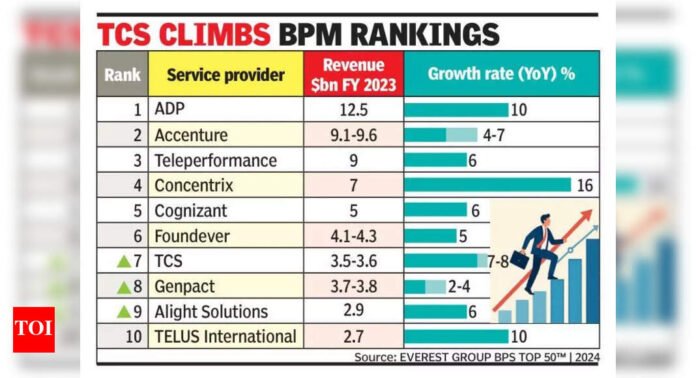

Leading BPM Providers and Their Revenues

TCS is among the top ten global BPM providers. It generated $3.5 billion in revenue and achieved 8% growth in 2023. Infosys and Wipro’s BPM divisions ranked 30th and 31st, respectively. The global third-party BPS industry is valued at over $300 billion.

BPM players were evaluated based on absolute growth and percentage growth. The top 50 providers added $5.6 billion in revenue in 2023. This is a decline from $9.4 billion in 2022, due to the growth slowdown.

IT-BPS vs. Pure-Play BPM Providers

In 2023, IT-BPS providers surpassed pure-play BPS providers in revenue growth. They benefited from large integrated deals. IT-BPM players grew by 5.8% in 2023, down from 9.7% in 2022. Pure-play BPM providers grew by 4.8% in 2023 and 7.5% in 2022.

Diverse Services vs. Niche Specialists

Everest Group’s analysis indicates that in 2023, providers offering diverse services outperformed niche specialists. There was a 2 percentage point difference in performance. In the previous year, both categories grew at similar rates.

Customer Experience Management (CXM) encountered significant revenue challenges. This was due to workload transfers overseas and volume reductions in cyclical sectors. These changes impacted specialist firms.