Indian Diaspora Sets Record with $135.46 Billion in Remittances

India Leads Global Remittance Charts for Over a Decade

Remittances make up over 10% of total gross current account inflows.

The Indian diaspora has sent a record-breaking $135.46 billion back to India in the last fiscal year. This impressive figure highlights India’s position as the top recipient of diaspora remittances globally for over ten years.

Remarkable Growth in Remittances

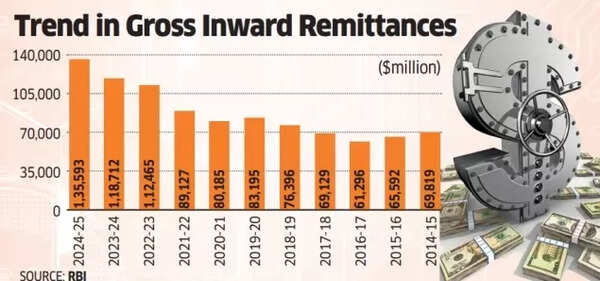

The Reserve Bank of India reports a 14% increase in gross inward remittances from non-resident Indians. This growth has more than doubled the remittances from $61 billion in 2016-17.

According to RBI data, remittances account for over 10% of the total gross current account inflows, which amounted to $1 trillion for the fiscal year ending March 31.

India’s Affordable Remittance Market

An RBI research paper highlights that India offers one of the lowest costs for transferring $200. This affordability makes it easier for the diaspora to send money home.

Trend in Gross Inward Remittances

Skilled Labor Fuels Remittance Growth

“The strong growth in remittances continues despite weak crude oil prices,” said Gaura Sengupta, chief economist at IDFC First Bank. She added, “This is due to the increasing share of skilled labor migrating to developed markets like the US, UK, and Singapore. These three countries account for 45% of total remittances.”

Remittances from Gulf Cooperation Council (GCC) nations are usually affected by oil prices. However, the share of GCC countries in total remittances has been decreasing.

Significance of Remittances in India’s Economy

Income from software and business services are major current account inflows. Each surpassed $100 billion in the previous fiscal year. Together with remittances, these three streams contributed to over 40% of the total gross current account inflows.

“India’s remittance receipts have generally been higher than gross inward foreign direct investment (FDI) flows. This highlights their importance as a stable source of external financing,” noted an RBI report.

These remittances play a crucial role in supporting India’s trade deficit financing. In FY25, gross inward remittances made up nearly half (47%) of the country’s merchandise trade deficit of $287 billion.

India Tops Global Remittance Charts

World Bank data shows India as the leading recipient of inward remittances. In 2024, Mexico ranked second with estimated inflows of $68 billion, while China followed in third position with approximately $48 billion.

Inward remittances globally represent cross-border household income flows. These result from temporary or permanent migration to foreign economies. According to the International Monetary Fund’s 2009 definition, remittances appear in two balance of payments categories:

- Compensation of employees under the primary income account

- Personal transfers under the secondary income account

For India, personal transfers, mainly consisting of inward remittances for family maintenance from overseas Indian workers and local withdrawals from non-resident deposit accounts, form the primary component of cross-border inward remittances.