Trump’s Tariff Strategy: Altering India, China, and the Global Economy

Intensifying Trade Conflict and Its Consequences

US President Donald Trump is escalating his global trade war, targeting not just China but also allies like India. As part of his “America First” economic strategy, Trump announced that India will face reciprocal tariffs starting April 2, claiming that the country imposes some of the highest duties on US goods.

China’s Excessive Exports and the New “China Shock”

Meanwhile, his crackdown on Beijing is triggering a new “China Shock,” as excess Chinese exports flood global markets, disrupting industries and destroying jobs worldwide. The world’s largest exporter, facing increased trade barriers in the US, is flooding other markets with cheap goods—undercutting local manufacturers and eliminating jobs from Mexico to Indonesia to India.

Trump’s View on India’s Tariffs

In an interview with Breitbart News, Trump said that while India is a “wonderful nation,” it has tariffs that are unfair to the US. “I have a very good relationship with India, but the only problem I have is they’re one of the highest tariffing nations in the world,” he said. “I believe they’re going to probably be lowering those tariffs substantially, but on April 2, we will be charging them the same tariffs they charge us.”

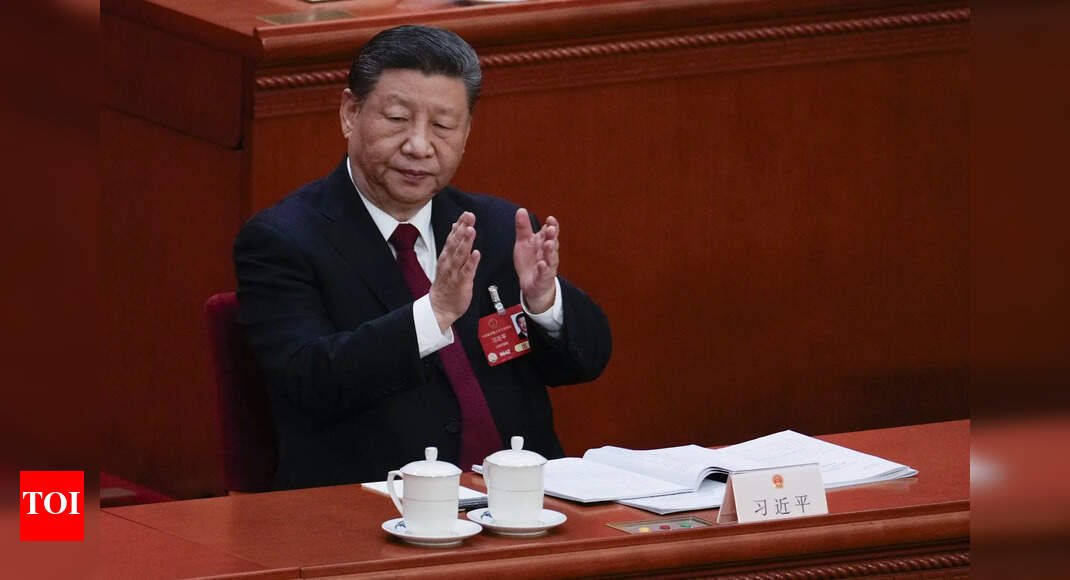

China’s Economic Growth and Trump’s Aggressive Approach

On China, Trump is taking an even more aggressive stance, arguing that Beijing’s economic expansion is hurting American workers and destabilizing industries worldwide. His latest tariffs are designed to curb China’s influence, but they are also causing widespread disruptions in other economies that rely on trade with China.

Economic Impact in Southeast Asia

The economic fallout is already visible in Southeast Asia, where Chinese exports—redirected from the US due to tariffs—are undercutting local businesses.

Why It Matters

Trump’s tariff war is not just a US-China showdown—it’s reshaping global trade patterns, forcing countries like India to make tough choices and wreaking havoc on emerging markets:

- India’s predicament: While Prime Minister Narendra Modi has cultivated strong ties with Trump, India is scrambling to reduce trade tensions. In recent weeks, it has lowered duties on bourbon, high-end motorcycles, and certain agricultural goods. More tariff reductions could follow as Indian officials work to avoid a full-scale trade war with the US.

- China’s oversupply issue: With US import barriers rising, Chinese manufacturers are aggressively seeking new markets. The result? An oversupply of Chinese goods in countries like Indonesia, Mexico, and Brazil, putting pressure on local producers.

A Global Economic Risk

Trump’s tariffs have already rattled markets. As April 2 approaches, uncertainty is growing, with investors worried about inflation and supply chain disruptions. Federal Reserve Chair Jerome Powell recently noted, “Uncertainty is remarkably high.”

The New “China Shock” and Its Impact on India and Others

- Trump’s trade war is also fueling a second wave of the “China Shock,” a term used by economists to describe the massive economic disruption caused by China’s rise as a manufacturing powerhouse in the early 2000s. Now, as Trump closes the door on Chinese imports, those products are flooding global markets—leading to economic distress in countries from Indonesia to Mexico.

- India in the crosshairs: India is feeling the heat. Authorities in New Delhi have launched anti-dumping probes into a range of Chinese products, including solar cells and mobile phone components, to shield domestic industries. Meanwhile, local textile producers are struggling to compete against a flood of inexpensive Chinese garments.